Smarter Money Habits, Together

Pickl connects parents and teens through a shared finance app. Track spending directly from real bank accounts, set budgets, and build healthy money skills as a family.

Teens Struggle with Money Management

Without real visibility into spending, many teens miss out on learning how to manage their money, stick to budgets, or save for their goals. This lack of hands-on experience can create challenges as they enter adulthood.

Empowering the Next Generation with Financial Wisdom

Pickl is on a mission to help parents and teens work together to build strong financial habits. By linking bank accounts, setting budgets, and tracking real transactions, we help teens make smarter spending decisions—while giving parents the tools to guide and support.

Track spending.

Teach smart habits.

Build a better future.

All-in-One Financial App for Families

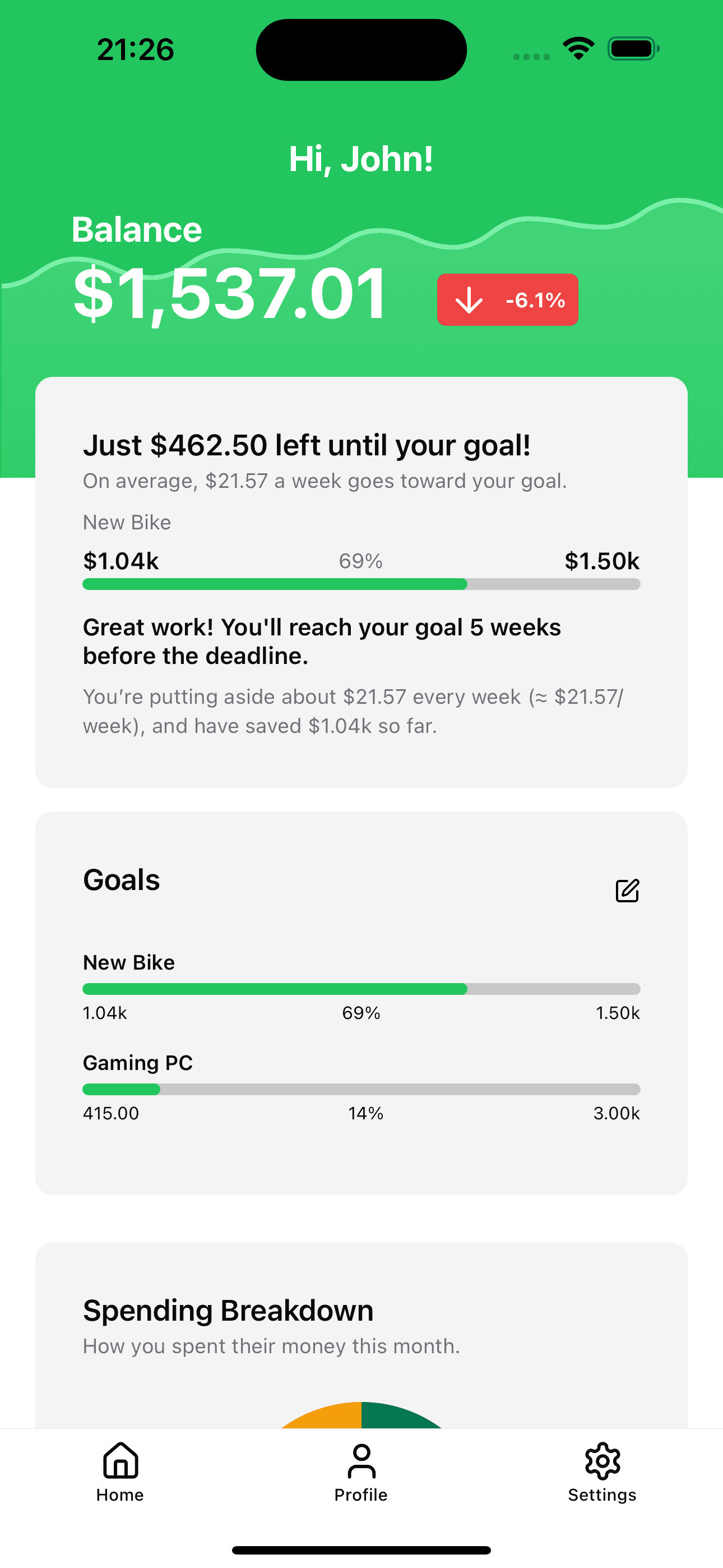

Pickl brings parents and teens together to build real money skills, with live spending tracking, smart budgeting, savings goals, and easy-to-understand feedback.

Live Spending Tracking

Connect real bank accounts to see every purchase, so parents and teens always know where money goes.

Parent-Set Budgets

Parents can set flexible spending limits for different categories, helping teens learn healthy boundaries while building trust.

Spending Score

Pickl’s unique score rates your spending habits—rewarding smart choices and giving feedback on how to improve.

Savings Goals

Teens set what they’re saving for, track their progress, and see how long it’ll take to reach their goal based on real trends.